Ripple executive chairman Chris Larsen has amassed millions in realized profit from XRP withdrawals since 2018, which grew significantly this year. Larsen moved another 50 million XRP from one of his wallets earlier this week to invest in the upcoming XRP treasury Evernorth.

XRP Realized Profit of Chris Larsen Reaches $764 Million

Ripple co-founder Chris Larsen has realized $764,209,610 in profit since 2018, according to on-chain data shared by analyst Maartunn on October 23. “Yes, the latest sale is tied to EvernorthXRP. But this isn’t an isolated event,” he added.

CryptoQuant on-chain data revealed how the XRP realized profit of Chris Larsen increased extensively in 2025, bouncing from under $200 million to hit over $750 million. Massive outflows from Larsen-linked wallets were noted by the crypto community amid XRP price rally, the SEC v.Ripple lawsuit end, and treasury announcements.

He highlighted that Chris Larsen has repeatedly cashed out XRP near local highs. This has caused whales to liquidate XRP holdings despite bullish price targets of $5 and even $10 by technical analysts.

Earlier this week, Larsen defused panic in the crypto community after confirming a 50 million XRP transfer from his wallet was linked to an investment in Evernorth treasury. This avoided further selloffs by whales and investors.

As CoinGape reported earlier, Evernorth announced to raise $1 billion, including $200 million from SBI, and additional investments from Ripple, Rippleworks, Pantera Capital, Kraken, and GSR.

Congrats @ashgoblue and the @evernorthxrp team on today’s launch! Evernorth fills the missing link today in XRP capital markets, and XRP usage in DeFi products. I’m proud to invest 50M XRP in the firm (you may see some wallet movement on this). https://t.co/AAbkO6WlZe

— Chris Larsen (@chrislarsensf) October 20, 2025

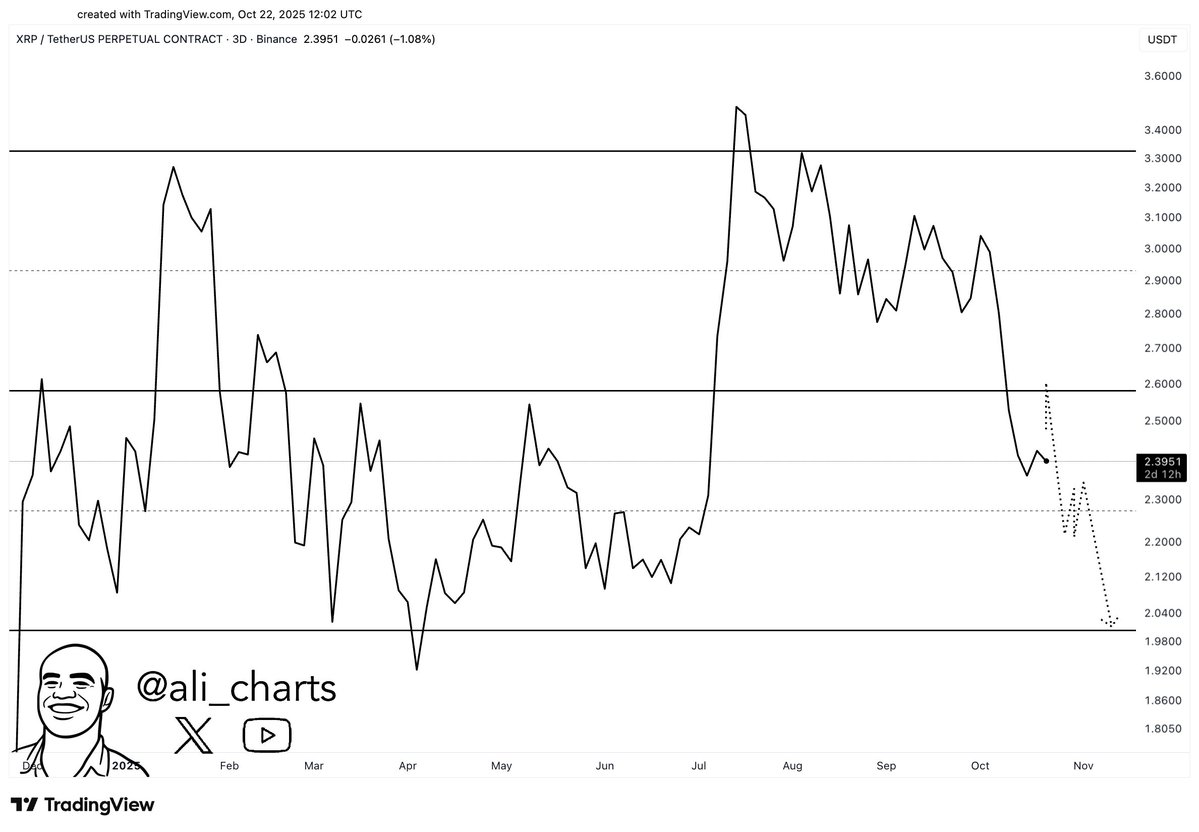

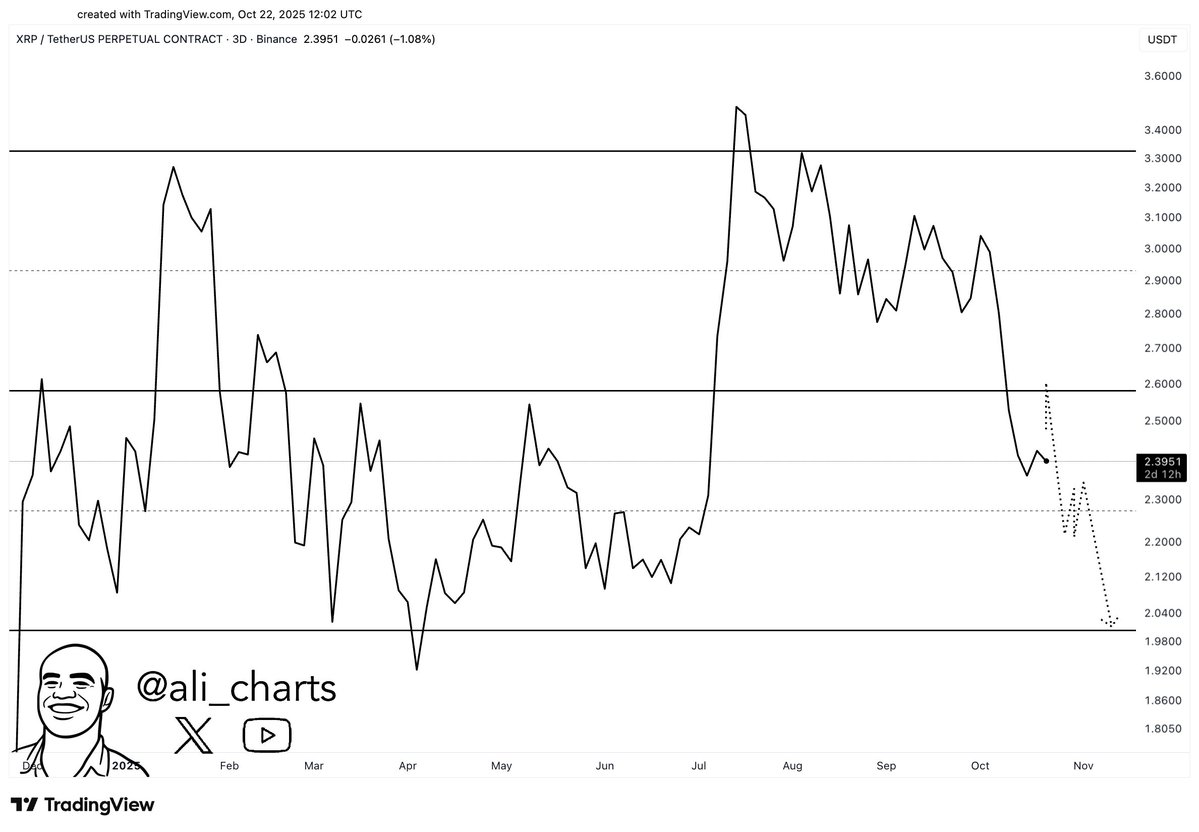

Ripple Coin Price Holds Above $2.30

XRP price fell more than 1.50% in the past 24 hours, with the price currently holding above $2.30. The 24-hour low and high were $2.34 and $2.44, respectively. Furthermore, the trading volume has decreased by 12% in the last 24 hours, indicating a decline in interest among traders.

In the daily timeframe, the price is below the 50-SMA, 100-SMA and 200-SMA at the time of writing. Whereas, the Relative Strength Index (RSI) maintains near 40.

Analyst Ali Martinez predicted $2 as the next key target if prices continue to slide and fail to reclaim the $200-DMA at $2.59. He expects profit booking in XRP to persist for a longer period.

CoinGlass data showed slight buying in the derivatives market in the past few hours. At the time of writing, the total XRP futures open interest dropped 1.76% to $3.71 billion in the last 24 hours. However, Ripple coin futures OI on CME and Binance climbed more than 1% and 0.5% in the last 4 hours, respectively. This signals cautious buying among derivatives traders.